Towards the end of 2016, our friends over at Software Advice, a homebuilding software consultancy, analysed small and midsize businesses (SMBs) and their needs when it comes to construction software. For three consecutive years now, Software Advice has been conducting an annual analysis of their construction software buyer consultations with the aim of studying buyer trends to understand the changes in these market trends over time. Their report for 2016 presented some interesting findings and insight into construction software industry and painted a clear picture of the buyers’ industry-specific needs.

To summarise their latest construction software buyer report, the key findings for 2016 are as follows:

60% look for estimating capabilities in a software.

24% want to increase project transparency and improve tracking.

50% are currently using manual methods to calculate takeoff, prepare bids, and manage projects.

As these small and midsize construction companies plan to expand, the study indicates that they are slow to adopt new construction software, that they look for software that would improve project estimating and tracking, and that they seek for useful software that would replace manual methods capable of supporting processes throughout the project lifecycle.

“Our 2016 analysis of trends among construction software buyers revealed an interesting finding: while pre-sale functions such as estimating and takeoff continue to top the list of capabilities most-often requested by consumers, we found that contractors are increasingly looking for solutions that streamline the actual build process. In fact, when taken together, project management (encompassing requests for project tracking, scheduling, and document management) is the number one capability required by SMBs.

We also found 6 percent of buyers specifically requested solutions with construction apps. These customers need tools that allow contractors and technicians access to the primary system while out on job sites. This makes critical information, such as RFIs and change orders, immediately accessible to all parties, helping to improve transparency and reduce errors.

However, it’s important to note that nearly every construction software available for cloud-based deployment is going to include a corresponding mobile application with the purchase of the subscription license. As such, the percentage of buyers looking for mobile connectivity is likely much higher than the 6 percent referenced above.”

– Eileen O’Loughlin, Market Research Associate for Software Advice

What Do First Time SMB Buyers Look for in a Construction Software?

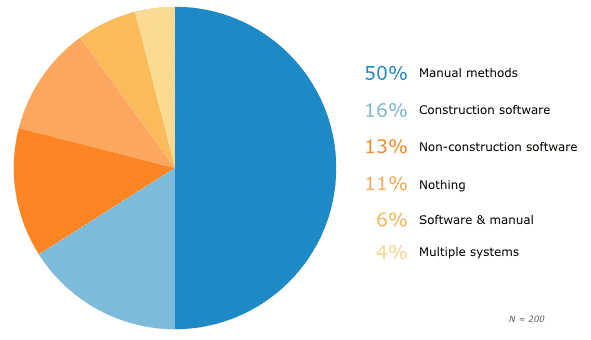

In the Software Advice report, fifty percent of the buyer sample still use manual methods, like the old school pen-and-paper and spreadsheets, to carry out tasks (from takeoff calculations to bid preparations and even project management). Thirteen percent use non-construction software to track projects and manage the financial aspects. This is still the practice even with the myriad of tools and software available in the market. Only about 26% of their sample looked to replace an existing construction software.

However, as these small construction companies grow, they tend to realise that spreadsheets and the classic pen-and-paper can no longer keep up with their business. They tend to look for project management solutions that provide the transparency and document tracking not offered by spreadsheet tools.

Prospective Buyers’ Current Methods, Software Advice 2016

Why Adopt Construction Software?

Companies are usually pushed to adopt construction software because of these three main reasons (Burger Consulting Group as cited in O’Loughlin, 2016):

- Business Expansion. As a company grows, the number of jobs increases, which needs to be managed efficiently and effectively.

- New People. With company growth comes new hires, which requires processes to be standardised.

- Mistakes (Claims/Suits). To minimise risks, a growing company has to find an effective approach to manage its projects.

These buying drives center around two key components within a company: Takeoff/estimating and project management.

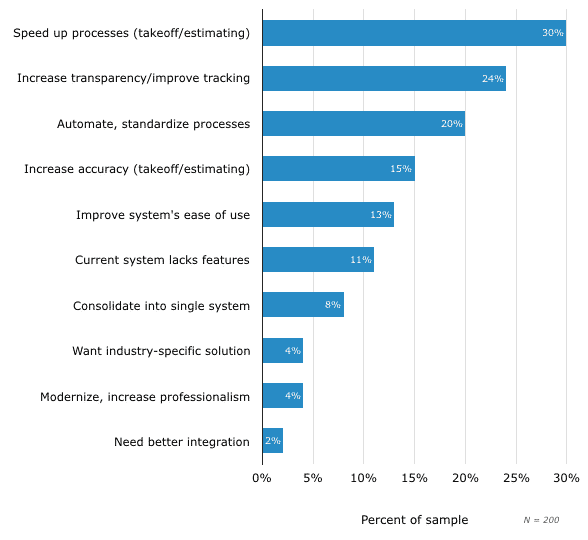

Top Reasons for Evaluating Construction Software

Pain Points, Software Advice 2016

As expected from a sample that exhibited the use of manual methods still, 33% of the buyers look for software that would reduce the time spent in performing the manual functions. Fifteen percent are interested in software that would increase their bidding process accuracy. Twenty-four percent of the buyer sample look for software that would allow better transparency and project tracking especially with regards to change orders and requests for information (RFIs). Another 20% look to automate and systematise their processes. If expanding SMBs fail to streamline and standardise their procedures, project managers will have a hard time managing multiple projects and would most likely lead to costly mistakes. These costly mistakes are easily preventable with the use of construction management software that could provide effective organisational and tracking solutions. Overall, buyers want functional software that can provide support for a company’s processes in the whole lifecycle of a project.

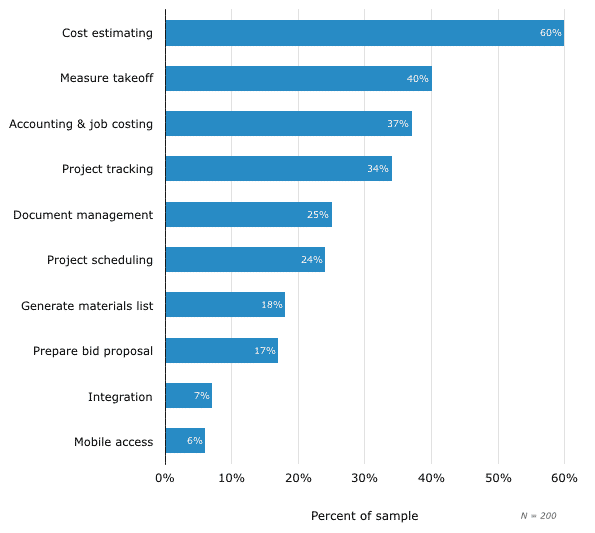

Top-Requested Construction Software Functionality

Pain Points, Software Advice 2016

As derived from the chart, the most necessary features are cost estimating (60%), measure takeoff (40%), accounting and job costing (37%) and project tracking (34%). These features are all fundamental for a construction company, however, usually are not found in one software solution. The current trend of how software solutions work together is that estimating tasks including takeoff, job site surveys and costings, and biddings are usually done in one solution. Once a job has been awarded, it gets turned over to project managers who use a separate project tracking software (which usually includes document management and scheduling). Project management software proves to be of great value as it is vital in managing the actual building process.

Software Advice recommends contracting companies to invest in a project management system that has mobile capability. This allows transparent project tracking among contractors, subcontractors, and other stakeholders while in the office and while out at the job sites. The real-time transfer of data allows for effective communication and efficient collaboration between all teams and stakeholders involved.

Conclusion

Results of the study suggest that investing in a stand-alone or integrated project management solution is highly recommended for construction companies. To further make a construction company’s system fully functional, it is also recommended to incorporate an estimating solution that is easily integrated with the project management software. A system that supports mobile apps increases a team’s productivity is also highly prescribed.

Introducing a technology or tool into the construction industry alone is not sufficient. As we have seen, these innovations need to be tailored to the context in which they are to function. Download our free ebook, The Circle of Productivity, to learn how you can improve productivity on your construction site using your choice of technology tool to tailor better documentation processes.